Losing a loved one is never easy and dealing with the legal complexities that often follow can add another layer of stress. Whether you’re seeking to understand the probate process, need guidance on how to apply for probate, or are concerned about issues like estate administration tax, the experienced team at Gale Law is here to provide clarity and expert representation during this challenging time.

In estate litigation, the most common issues often arise due to the absence of a will or disputes surrounding the validity or interpretation of a will. As a result, wills are a key component and a critical factor in the administration of estates. But you might be wondering: What is a will?

Wills: Explained

A will is a legal document in which an individual—known as the testator—expresses their wishes regarding the distribution of their assets or “estate” (any property or possessions owned by the deceased, such as money, real estate, investments, and other valuables). A will should specify the following:

- Who they would like to be responsible for administrating their estate when they die (the estate trustee)

- Who they would like receive their estate after they die (their beneficiary)

- How debts are to be paid and any explanation as to why a loved one may be excluded from their will or a reason the estate is not divided equally, if needed.

Wills provide a person the opportunity to dictate who should be in receipt of their money/property (estate) after they die and who should administer their estate. It is worth noting while you can leave instructions as to how you wish to buried/cremated, the estate trustee has discretion and no legal obligation to follow these wishes. It is therefore important to pick an estate trustee you trust.

Challenging A Will

A will challenge is where someone disputes (disagrees with) the validity (legal acceptability) of the Last Will and Testament of a deceased. A testator (person who wrote the will) must have had legal capacity to execute a will, not have been unduly influenced, and have had knowledge and approval of the contents of the will. The will must be signed and executed properly for the will to be valid.

It is up to the person propounding the will (the person alleging the will is valid) to establish, on a balance of probabilities, that the deceased had testamentary capacity (meaning mental ability, which is a legal test) when the will was executed (written). However, if undue influence (external pressure from others) is being alleged, it is up to the person alleging undue influence to prove its existence.

In Ontario, the process for legally challenging a will is as follows:

1. Speak with a Lawyer

An estate litigation lawyer can help you understand the process, review the strength of your case, explain the legal costs and answer any of your questions. At Gale Law, we practice exclusively estate litigation and have regularly acted for clients seeking to challenge or uphold wills.

2. File a notice of objection or return of Certificate of Appointment of Estate Trustee

A Notice of Objection will require the challenger to describe the reasons they consider the will to be invalid (not legally acceptable) and their financial interest in the estate. This Notice, filed with the court registrar, will pause the appointment of an estate trustee if not yet probated (not legally granted yet and no Certificate was issued). If the estate trustee has already been appointed (the will was probated and a Certificate was issued) then you may need to motion (legal request) to have the Certificate of Appointment of Estate Trustee be returned to the court.

3. Provide Evidence

This will require you to show evidence for the reasons you are challenging the validity of the will. For instance, if you are claiming that the testator lacked testamentary capacity, you might require medical records and a retroactive capacity assessment.

4. Judge Looks at Evidence

The judge will look at all evidence presented to determine the validity of the will. If this matter is brought in Toronto, Windsor, or Ottawa then the parties must attend mediation (an attempt to settle the matter out of court; mediation is mandatory per Rule 24.1 ) before a final hearing of the matter. Kim Gale has a Masters of Law in Dispute Resolution and is a mediator for estate disputes.

Dying Without A Will

Without a will, a deceased’s estate will be administered (given out) based on the Rules of Intestacy. The rules of intestacy essentially provide a “will written by the law” for those who die without a will or for those who have a will but that does not clearly explain the distribution of their estate or “who gets what”; when a situation like this occurs, it is called a “partial intestacy”.

While the Rules of Intestacy provide a route for administering (giving out the estate) for those who die without a will, it might not always be reflective of your personal life circumstances. For example, based off the rules of intestacy, a common-law spouse will not automatically receive anything from their deceased’s partners estate.

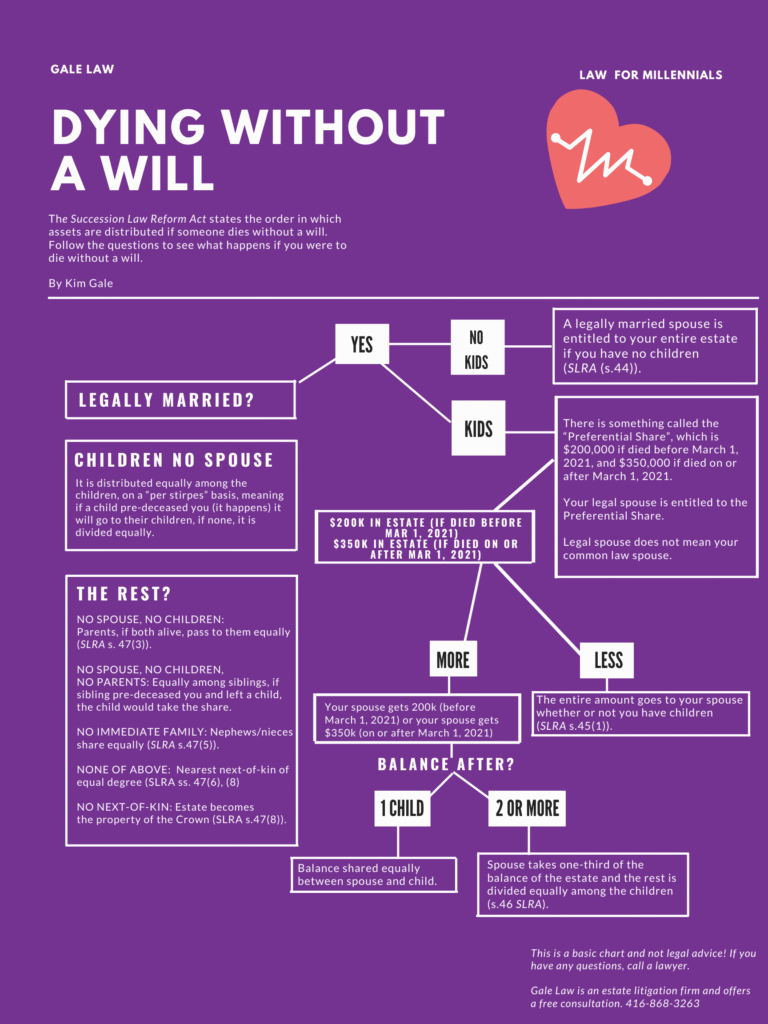

It is important to have a will for tax planning purposes as there may be legal ways your assets may be held which allow you to avoid paying additional taxes. The flow-chart below exemplifies how the rules of intestacy are outlined in the Succession Law Reform Act.

Need help navigating probate?

Frequently Asked Questions

Probate is the court process that confirms a Will is legally valid and gives the estate trustee authority to manage the estate. In Ontario, probate is usually required when the deceased owned real estate (not held jointly) or when financial institutions request a court certificate before releasing funds.

To apply for probate, the estate trustee must file specific forms with the Ontario Superior Court of Justice, including the original Will, death certificate, and a calculation of estate administration tax. The court then issues a Certificate of Appointment of Estate Trustee, granting authority to manage the estate.

Estate administration tax (sometimes called probate fees) is calculated based on the total value of the estate. It must be paid when applying for probate, and the estate trustee is responsible for ensuring the tax is paid out of estate funds.

Disputes may arise because of unclear Wills, disagreements over fairness, concerns about mental capacity or undue influence, or conflicts among family members. Grief can also intensify existing tensions.

We guide families through every step of probate—from preparing court documents to dealing with taxes and estate distribution. Our team ensures the process runs smoothly, reduces delays, and helps resolve conflicts if they arise.

A Will is a legal document that outlines how a person’s assets and property should be distributed after their death. Having a valid Will ensures your wishes are followed, reduces disputes, and makes the process easier for your loved ones.

An estate trustee (sometimes called an executor) is the person appointed to carry out the instructions in a Will. They are responsible for paying debts, filing taxes, and distributing assets to beneficiaries.

A beneficiary is a person or organization named in a Will to receive part of the estate. Beneficiaries can inherit money, property, or other assets.

Yes, a Will can include burial or cremation wishes. However, in Ontario, these wishes are not legally binding. While most families honour them, the estate trustee has final authority.

An estate trustee has significant responsibility, including handling money, paying debts, and distributing property. Choosing someone trustworthy ensures your estate is managed fairly and according to your wishes.

Let’s Talk Law

We simplify legal talk so you don’t have to Google it. Tips, trends, and thought pieces straight from our attorneys to help you stay ahead.